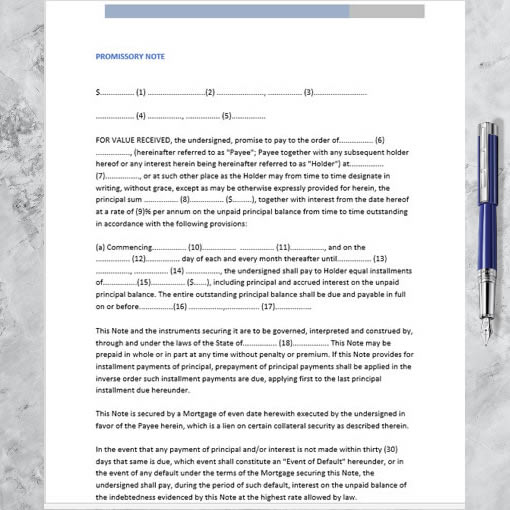

Microsoft Word Promissory Note (Loan contract) Template. A note that details money borrowed from a lender and the repayment structure. The document holds the borrower accountable for paying back the money (plus interest, if any). Download, edit & print in minutes.

Included:

- 3-pages Promissory Note contract template file

- Two formats – Microsoft Word Doc file (editable) & PDF file

Loan Agreement

Use our Loan Agreement to detail the terms of a loan between two businesses.

You should protect your financial position if you intend to lend or borrow money with a loan agreement. Our simple and straightforward loan agreement has everything required to protect the lender as well as the borrower and ensures that both parties are compliant with the law. Our Loan Agreement includes, how the loan will be repaid, any obligations under the agreement, repayment warranties given by the borrower, and how to end the loan agreement.

What is a loan agreement?

A loan agreement is a contract between two parties, where a lender agrees to lend a certain amount of money to a borrower. The loan agreement sets out the terms of the loan, including the repayment period, the interest rate payable, and any obligations on the parties.

When do I need a loan agreement?

You should use a loan agreement in the following circumstances:

- when you want to lend money to a business

- when your business wants to borrow money from another business, whether a company, LLP or partnership.

- If you’re going to lend money to another person and not a business, you should use a promissory note.

What terms are included in your loan agreement or loan contract?

Our loan agreement covers:

- the amount to be loaned;

- what the loan is for;

- how the borrower accesses the funds;

- repayment of the loan, when and how;

- the interest rate payable under the loan;

- the additional interest payable where a payment is missed;

- how early repayment can be made and any penalties;

- whether the loan is to be secured against an asset or unsecured;

- assurances or warranties to be given by the borrower;

- any obligations and restrictions on the borrower to help ensure that the lender will be repaid; and

- in which circumstances the lender can ask for immediate repayment of the loan.

Do I need a loan agreement?

A loan agreement is an essential document to help protect your financial position if you intend to lend or borrow money as a business. The loan agreement sets out the terms of how and when the loan will be repaid, giving all parties sufficient protection.

Examples of situations when you may use a loan agreement are:

Business start-up or growing your business – you require working capital or to grow your business, and you want to borrow from another business

Acquisition – you want to raise capital to acquire another business or asset

Joint Venture – you want to lend money to a business as an investment to get a good return on your capital.

What terms should the borrower repay the loan?

The repayment terms should be agreed between both parties in full on an agreed date.

What is the interest rate payable in a loan agreement?

Both parties should agree the annual interest rate that will be applied to the loan. The interest can be paid in monthly or quarterly instalments by the borrower. It can either be a fixed agreed percentage or a percentage above the base lending rate of a nominated bank.

In case of late payment by the borrower, another daily interest rate would apply as a penalty, payable from the date of non-payment to the date the actual late payment is made. The daily interest rate for late payment is a fixed percentage above the annual interest rate.

Does your loan agreement allow for early repayment by the borrower?

In our loan agreement, you can agree on a term that allows the borrower the option to by giving the lender a specific notice to repay the loan in full or in part at any time. You can also include a provision for an early repayment fee to be charged as a percentage of the loan amount.

What is the difference between an unsecured loan and a secured loan?

If the loan is unsecured, the lender has no security over any of the borrower’s assets and will not be able to take control over any assets if the borrower does not pay and defaults on the loan.

A secured loan is where the borrower offers an asset such as real estate to the lender as collateral. This means that if the borrower doesn’t pay or defaults on the loan, the lender can take control or ownership of the asset. If you want to secure your loan, a separate ‘Security Document’ will need to be drafted.

As the lender can I ask for immediate repayment of the loan?

As the lender, you can cancel the term of the loan and ask for immediate repayment in the event of default by the borrower.

A default by the borrower is where the borrower fails to pay the sums payable on their due dates or breaches any of the provisions of the loan agreement.

Loan agreements are also known as:

Loan contract

Money lending agreement